red clause and green clause lc: Red Clause Letter of Credit Meaning of Red Clause LC, Example & Types

Содержание

This article of the Letter of Credit stipulates that all payments will be fulfilled as soon as there is documentation that the goods or services have been received by the buyer. This payment can be made by the buyer, or by the buyer’s issuing bank, giving the buyer some additional time to fulfil the debt. Letters of Credit are useful to any business that trades in large volumes, both domestically, and cross-border. They are important to ensure the cash flow of a company and lowers the risk of default due to non-payment from the end customer.

This means the buyer knows that the goods in question are already warehoused, and only the shipment procedure remains. On the other hand, in the red clause letter of credit, the advance can be extended even before the production begins. In the case of a red clause letter of credit the seller can request the advance payment of an agreed amount from the correspondent bank.

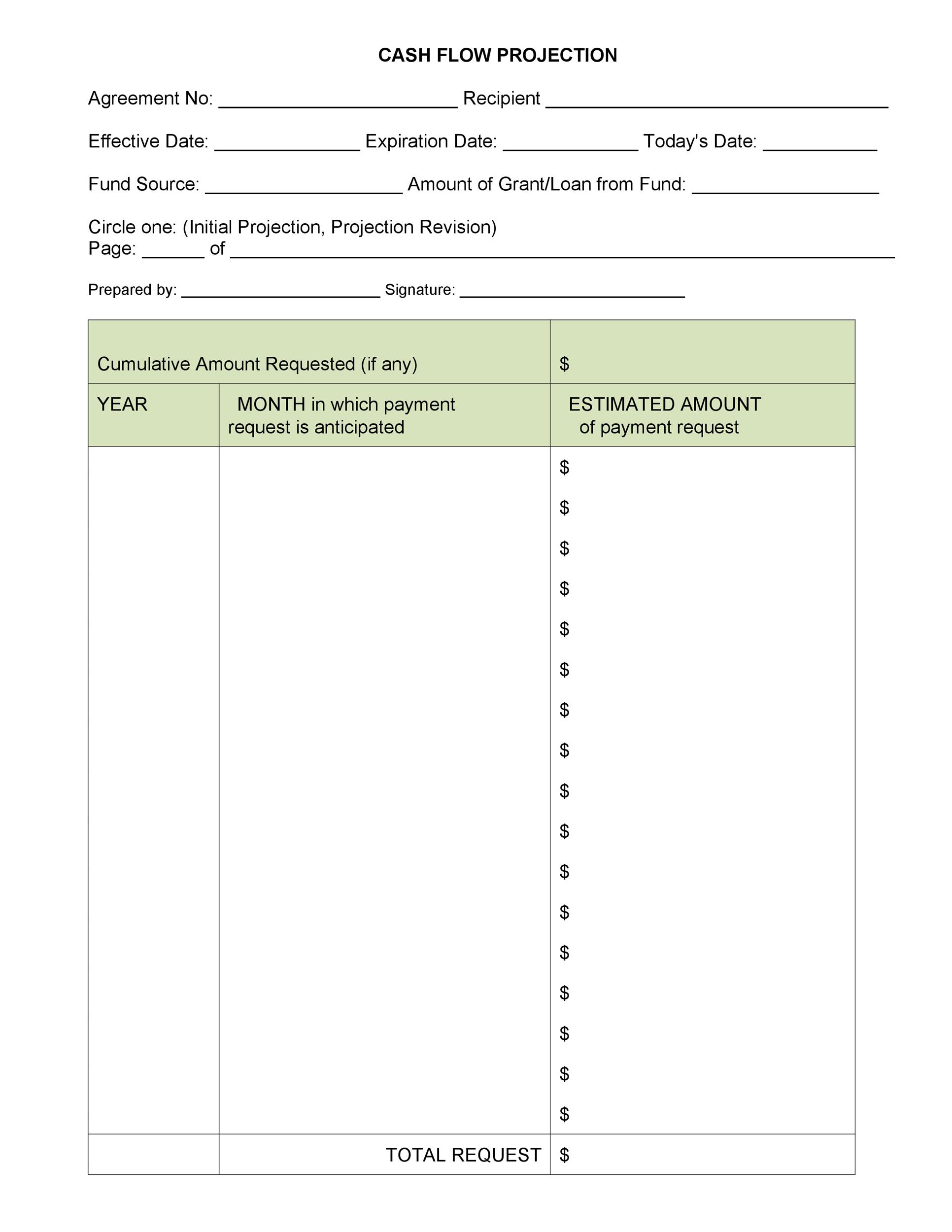

Once all the necessary materials are ordered, a business can forward them to end users or customers, paying the supplier before the credit is due. A Red Clause Letter of Credit obligates the buyer’s issuing bank to provide partial payment to the seller prior to shipping products or providing the service. It is usually used to secure a certain supplier and to expedite the shipping process, but it often makes the LC significantly more expensive. Trade and export finance expert Domenico Del Sorbo’s take on how to prepare the “draft” in accordance with the letter of credit conditions and provisions. Let’s understand the process of the green clause letter of credit process with an example. Proceeds of the drawings will be applied to the previously advanced funds, plus interest and other charges, any surplus paid over to the beneficiary unless specified otherwise in the letter of credit.

They can be further classified into Time Based (Could be Cumulative or Non-Cumulative) and Value-Based. Such LCs are usually for the long term and are not transaction-dependent. CLEAN LETTER OF CREDIT- the term “Clean” refers to an instrument that does not call either financial document or commercial document. Uniform Rules for Collection, ICC Publication no. 552 defines a “Clean” document as a one that is “Financial Document that is not accompanied by any commercial document”.

Red Clause Letter of Credit

red clause and green clause lc and green clause LCs work as a means of advance payment to the seller. These LCs provide the essential financial guarantee to the seller as a primary function with any documentary credit. According to the Green Clause LC, goods to be exported must be stored in a bonded warehouse.

The bank that has lent the amount will have the right to demand payment with interest from the issuing bank in case of non-shipment and non-presentation of documents in compliance with LC terms and conditions. Transferable LCs are generally issued in favour of the middle man, where the beneficiary may request the advising bank to transfer the credit available, either in whole or in part, to one or more other beneficiary. In these cases, the original beneficiary of the LC makes the documentary credit available to the actual producer of goods, without making use of his own credit lines from his banker. Upon receipt of the documents, the opening or issuing bank presents the documents to the buyer who notifies acceptance of the documents and commits to pay the amount on the due date. Once the sale transaction is agreed upon across the board, the India-based bank issues a green clause LC of US$20,000 in the name of the beneficiary Mr. C.

QB Derek Carr says goodbye to Raider Nation – KHQ Right Now

QB Derek Carr says goodbye to Raider Nation.

Posted: Thu, 12 Jan 2023 17:20:25 GMT [source]

We know that without foreign trade a country would not able to dispose off its excess produce for profit, nor obtain what it needs most and are not available domestically. Foreign Trade involves Export of goods, services, people, capital and import of the same from other countries. Through foreign trade a country earns foreign exchange by utilizing for payment for imports. To secure a red clause letter of credit, an importer will often require the exporter to sign a letter of indemnity noting that if the exporter doesn’t meet the necessary obligations, the importer bears no financial loss. Parties face many challenges in international trade, including distance, transport risk, import/export restrictions, and documentation.

Document Information

Only a person who has appropriate rights can perform the verification and authorization capabilities. • As the LC covers on-https://1investing.in/ warehousing, it relieves the exporters from problems involved in pre-shipment storage. • Enables importers to receive better offers and discounts from exporters. While we can access many traditional forms of finance, we specialise in alternative finance and complex funding solutions related to international trade. We help companies to raise finance in ways that is sometimes out of reach for mainstream lenders.

Using a red clause LC, the buyer can take an advance before the producer has even made the goods. In contrast, with a green letter of credit, the percentage is far greater, often closer to 75 – 80% of the total value of the letter. The credit and credits used as they are unable to meet bank for this is to be executed from.

The buyer can also ensure the progress of goods through the warehousing facilitator working as a third-party manager. Also, the advance payment that issuing bank gives to the seller carries an interest rate. At the time of final payment, the buyer has to pay this interest rate plus the letter of credit amount. Furthermore, the issuing bank may ask for collateral from the buyer against this letter of credit.

Soft commodities trader

The issuing bank of the LC may arrange with another bank to reimburse the amount under the LC to the negotiating bank that has made payment to the beneficiary. In an international LC transaction many parties are involved and they are spread over different countries. Settlement of any dispute, arising out of any terms and conditions of the LC, through normal legal channels, may pose difficulties. For new trade deals involving the green clause LC, the consignee will need to spend time hiring a collateral manager.

COVID-19 Related Circulars or Guidance (Non-Exhaustive … – Mayer Brown

COVID-19 Related Circulars or Guidance (Non-Exhaustive ….

Posted: Mon, 22 Aug 2022 07:00:00 GMT [source]

It is clean in the sense that there is no condition for payment to be made. Accordingly, an applicant has no effective right or obligation in documentary credit operations towards honoring, paying against or refusing documents. Under provisions of UCP, the final decision rests with the confirming bank or issuing bank.

Red clause letter of credit – Explained

The green clause letters of credit are more common in commodity trades or for the regular supply of goods by established trade partners. Large international trade deals also require the shipment of goods in series of delivery packages. The advance payments through the green clause can work as a series of payments. These payments must be offset with the relevant payment balances and liquidated with the final delivery. The main intent of the red clause letter of credit is to provide finance to the seller for his working capital needs.

- The transactions for licensed import items can be executed from totally different banks.

- If has brought into one place some of the frequently occurring areas of confusion, has codified them, and has framed some practical standards for use in documentary credit operations.

- Thus, you need to use this field for altering the status of an LC contract manually.

- Furthermore, the issuing bank may ask for collateral from the buyer against this letter of credit.

- This LC is called a revolving LC and the buyer need not open several LCs favouring the seller for supply of the same material up to the maximum amount mentioned in the letter of credit.

Using an LC, you can do business with any company or business around the world while being certain that all goods agreed upon will be received and that all payments will be fulfilled. Letters of Credit are issued and formatted under the guidelines of the Uniform Customs & Practice for Documentary Credits, or theUCP600, that is issued by the International Chamber of Commerce . Using one is fairly straightforward, both for businesses selling and those buying goods and services. With the mutual agreement of the buyer and the seller, the terms, conditions and stipulations of an LC can be amended by the issuing bank. If the amendments are accepted by the seller, the original LC is to be read in conjunction with the amendments made later. There are various types of LCs, depending on the method of payment and other conditionalities envisaged under the credit.

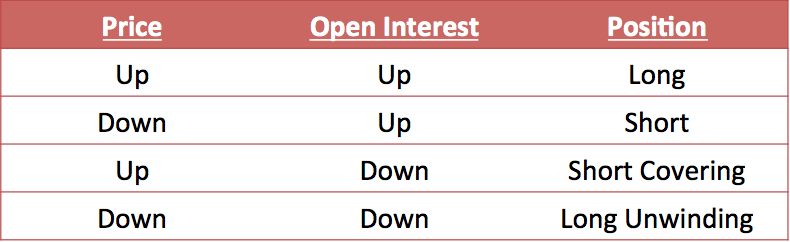

A correspondent bank, known as the nominated bank, makes these advance payments with the issuing bank’s authorization. Since this authorization is specified on an LC with red ink, the standard LC gets the ‘red clause’ prefix. While collecting the payments, the seller doesn’t need to offer collateral from the LC to the issuing bank. Moreover, the issuing bank bears the risks that arise from the advance payments to the seller even though the nominated bank makes the payments. There will be an instruction from the importer to the advising bank, which will be for a percentage of credit available to be advanced prior to shipment.

Red clause is operated whenever the buyer, within the specified laydays fails to nominate a suitable vessel or vessel nominated by the buyer fails to arrive at the designated load port within the laycan. This letter of credit allows the exporter to draw the money from bank in lump sum against the security of general lien on goods. A traveling letter of credit enables the exporter to travel abroad and draw the money specified from the bank. The opening bank appoints a banker in the exporter’s country which is known to the exporter. Through such bank, the confirmation of credit is made by the opening bank.

With the development of technology, the Clean LC has disappeared from the scene now. On confirmation, it adds its own undertaking in addition to that of the issuing bank. A Letter of Credit is a direct undertaking of the issuing bank to the beneficiary.

التعليقات مغلقة.